Introduction

So far in this blog series we’ve discussed setting your business up for payroll, calculating a paycheck, the difference between pre- and post-tax deductions, and how to calculate withholdings. In this blog post, we will discuss the frequency of payroll tax deposits, calculating payroll tax deposits, and payroll tax reporting.

When to Deposit Payroll Taxes

The frequency of depositing payroll taxes is dependent on what kind of labor you have and the amount of your annual tax liability. Table 1 summarizes how often tax deposits have to be made. Annual agriculture deposits are made with Form 943 (discussed later); this is filed in January of the year following the tax liability (for 2020 payroll tax liability, the payment would be made in January of 2021). Monthly deposits are due on the 15th day following the month the tax liability was incurred (for March paychecks, the tax deposit would be made by April 15th). There are separate time periods for semi-weekly depositors. If the payday falls on Wednesday, Thursday or Friday; the deposit is due on the following Wednesday. If payday falls on a Saturday, Sunday, Monday or Tuesday; the deposit is due on the following Friday. Non-agriculture labor with quarterly deposits are reported with Form 941 (discussed later). The first blog post in this series “What You Need to Know About Payroll: How to Start Your Business on Payroll” has details on determining if you have agriculture or non-agriculture labor.

Table 1: Summary of Deposit Schedule

|

Annual Tax Liability |

Annually |

Quarterly |

Monthly |

Semi-Weekly |

|

|

Agriculture Labor |

< $2,500 |

X |

|

|

|

|

$2,500 – $50,000 |

|

|

X |

|

|

|

> $50,000 |

|

|

|

X |

|

|

Non-Agriculture Labor |

< $2,500 |

|

X |

|

|

|

$2,500 – $50,000 |

|

|

X |

|

|

|

> $50,000 |

|

|

|

X |

The State of Illinois will determine your deposit schedule based on your tax liability but it will always be either semi-weekly or monthly for ALL types of labor. If you exceed $12,000 in Illinois withholding for a quarter, you must pay the withholding amounts semi-weekly. The due dates for the state deposits are the same as the federal deposits for monthly and semi-weekly depositors, respectively.

Calculating Payroll Deposits

Calculating the payroll tax deposit is fairly straight forward. There are three different components:

1. Federal withholdings from paychecks

2. Social Security and Medicare tax withheld

3. Employer match of Social Security and Medicare tax

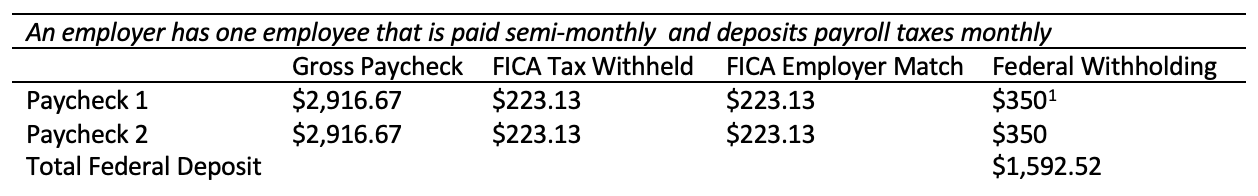

The employer’s payroll tax deposit will be the sum of the three components above for EACH paycheck of EACH employee in a pay period. Let’s look at an example below:

In this example, the total deposit amount is determined by adding together the FICA tax withheld, the FICA employer match, and the federal withholding from both paychecks. If an employer had more than one employee, they would complete the same process for each employee and the sum of the total deposit for each employee would be their total payroll deposit for the period. The deposit for the State of Illinois is simply the amount withheld for state income taxes from each employee’s paychecks for that deposit period.

Payroll Tax Reporting

There are three main federal payroll tax reporting forms for employers to be aware of: Form W-2, Form 941 and Form 943. Form W-2 is an annual Wage and Tax Statement; these report the gross wages paid to employees as well as their total FICA, Federal, and State taxes withheld. They must be furnished to each employee and be completed and distributed before January 31st of the following calendar year. Every employer who files Form W-2’s must also file a Form W-3; this summarizes all Form W-2 information filed for a particular business to the Social Security Administration (SSA). Form 941 is the Employer’s Quarterly Federal Tax Return. This needs to be filed EVERY quarter for all non-agriculture labor. If the tax liability for the quarter is less than $2,500 it can be paid with a voucher for Form 941. The due date for the Form 941 is the last day of the month following the end of the quarter (see Table 2). Form 943 is the Employer’s Annual Federal Tax Return for Agricultural Employees; this is only filed for agriculture labor. If your annual tax liability is less than $2,500, you can pay it once with the Form 943. The due date for this return is January 31st of the following calendar year.

The State of Illinois requires ALL employers file an IL Form 941 quarterly. These reports are due the last day of the month following the end of the quarter.

Table 2: Summary of Reporting Due Dates

| Form | Due Date |

| Form W-2 | January 31st |

| Federal Form 941 | April 30th

July 31st October 31st January 31st (of the following year) |

| Form 943 | January 31st (of the following year) |

| IL Form 941 | April 30th

July 31st October 31st January 31st (of the following year) |

Miscellaneous Payroll Information

If you are a monthly or semi-weekly depositor, you are required to deposit taxes through the Electronic Federal Tax Payment System (EFTPS). Form 941 filers who are only required to deposit once a quarter and Form 943 filers who are only required to deposit annually can pay by check with a voucher. Illinois deposits can either be paid by check or through the MyTaxIllinois website. ALL payroll forms/reporting/deposits are on a calendar year basis (even if your business is a fiscal year tax filer). If you are hiring your own child under the age of 18, you are not required to withhold Social Security and Medicare tax. Lastly, it’s important that you keep all records for reporting and deposits for at least four years after the due date or the date of payment.

Conclusion

This blog series has covered many different aspects of payroll and has hopefully improved your understanding of this important business topic. Not all of them apply to every employer, and it’s always important to consult with a professional on which pieces apply to your specific situation.

[1] Federal withholding was based off a Single Filer with no additional income.

and then

and then