Introduction

So far in our payroll series, we have discussed how to prepare your business for payroll, how to calculate a paycheck, what the differences between pre- and post-tax deductions are and unemployment taxes. In this blog post, we are going to discuss how to calculate withholdings from an employee’s paycheck. There are three main taxes to withhold: FICA, Federal and State.

FICA Tax

FICA (Federal Insurance Contributions Act) Tax is comprised of two parts: Social Security and Medicare. The total FICA tax is 15.3% (12.4% to Social Security and 2.9% to Medicare). All taxpayers must pay the tax on any income that is subject to FICA (some exceptions include per diem and mileage reimbursements, certain emergency workers, and certain accident and health insurance premiums paid by the employer). Half of the FICA tax, 7.65%, is withheld from the employee’s paycheck and the employer contributes the other 7.65% on behalf of the employee. Wages up to $137,700 [1] are subject to the Social Security tax; there is no wage limit for the Medicare tax and an additional 0.9% is withheld for an employee whose gross wages are greater than $200,000. Let’s look at an example below:

Example 1: An employee has an annual salary of $35,000 and gets paid monthly with no other deductions.

| Gross Paycheck | $35,000 / 12 | = | $2,916.67 |

| Social Security to withhold | $2,916.67 * 6.2% | = | $180.83 |

| Medicare to withhold | $2,916.67 * 1.45% | = | $42.29 |

Federal Withholding

In an earlier blog post, we discussed that each employee will need to complete a Form W-4 and the employer must retain that form in their business records. Form W-4 assists the employer in determining the amount of federal tax to withhold from the employee’s paycheck based on their filing status, dependents, and other income earned. There are two ways to determine an employee’s federal withholding: the Wage Bracket Method and the Percentage Method. Both of these methods use tax withholding tables to determine the amount of federal tax to withhold from employee’s paychecks. The wage bracket method uses frequency of pay (bi-weekly, semi-monthly, monthly, etc.) and the employee’s filing status to determine the dollar amount to withhold from each paycheck. This method can only be used if the annual income of the employee is less than $100,000. For 2020 W-4’s, employers can use the worksheet in IRS Publication 15-T, page 7, to determine withholdings.

The percentage method can be used on any amount of wages but is especially useful for unusual pay periods and wages paid over $100,000. This method is slightly more involved because it requires the employer to take a percentage of wages over a certain amount in addition to a base amount to withhold depending on filing status and payroll frequency. A worksheet can be found on page 51 of IRS Publication 15-T to assist with this calculation.

State of Illinois Withholdings

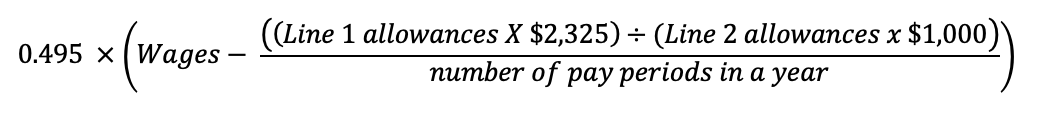

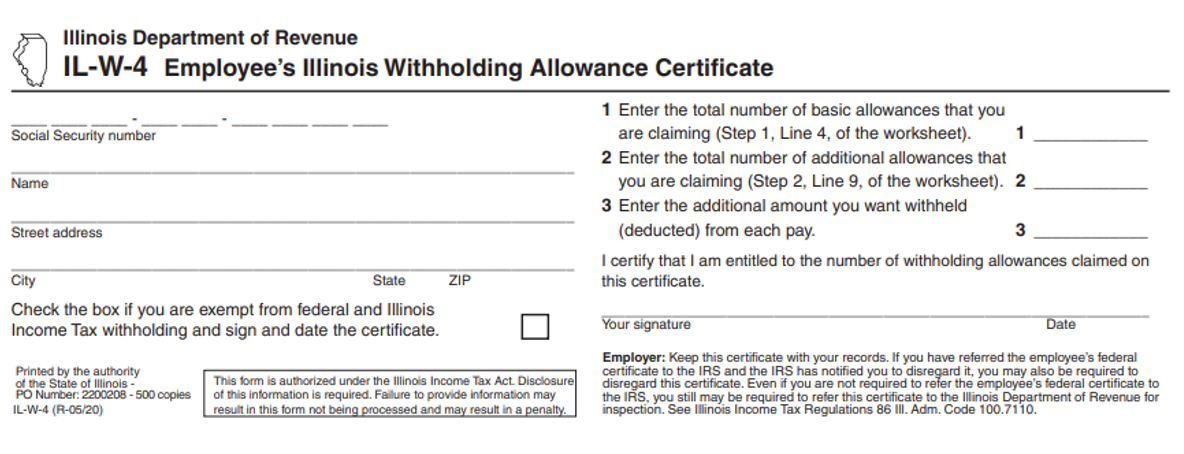

Similar to the Federal withholdings, the State of Illinois uses withholding tables in IL-700-T. In order to determine the correct amount to withhold, an employer will need the type of pay period, wages per pay period and the number of allowances claimed on the IL W-4. An alternate method, is to use the automated payroll method which can be found on page 4 of the IL-700-T booklet. The formula is below:

![]()

Figure 1 is an example of the IL-W-4 that an employer would keep on record. The equation above uses the numbers on Lines 1 and 2 to determine the amount to withhold.

Grossing Up

A previous blog post discussed the “Gross Up” method of calculating FICA tax. In this case, the employer wishes to pay both halves of the FICA tax as a benefit for the employee. There are two different ways to do this calculation depending on if you have agriculture labor or non-agriculture labor. The calculation for agriculture labor is simply taking the paid wages to the employee and multiplying them by 7.65%; this represents one half of the FICA tax for the employee. When the Form W-2 (discussed in a later blog post) is filled out for the year, this amount will be added to their Box 1, Gross Wages as a benefit to the employee (subject to Federal and State tax). For non-agriculture labor, you take the paid wages divided by 92.35% (1-7.65%). In this case, the amount of the FICA tax paid on the employee’s behalf is added to Box 1, 2, and 3 on their Form W-2 at the end of the year.

Conclusion

Determining the amount of tax to withhold from an employee’s paycheck can be complex. While this blog post gives a brief overview of the general steps required, as always, it’s important to consult with your tax or accounting professional to ensure you have completed all the necessary steps and calculations for your specific situation. The next blog post in this series will cover calculating payroll tax deposits, when and how to make deposits and payroll reporting.

and then

and then